|

Understanding Pet Insurance in West Virginia: Frequently Asked Questions Pet insurance in West Virginia has become an increasingly popular topic among pet owners seeking to ensure their furry companions receive the best possible care. As the cost of veterinary services continues to rise, many are considering pet insurance as a viable option to mitigate unexpected expenses. However, understanding the nuances of pet insurance can be a daunting task. Below, we address some frequently asked questions to help clarify common concerns. - What is pet insurance and how does it work? Pet insurance is a type of coverage that helps offset the costs of veterinary care. Much like human health insurance, it requires a monthly premium, and in return, it reimburses a portion of the vet bills, depending on the policy. The specifics can vary widely between providers, so it's important to read the fine print.

- Why consider pet insurance in West Virginia? West Virginia, with its beautiful landscapes and rural areas, is home to a significant number of pets. Veterinary costs here, as elsewhere, can be prohibitive without some form of financial planning. Pet insurance can provide peace of mind, ensuring that financial constraints do not dictate the level of care your pet receives.

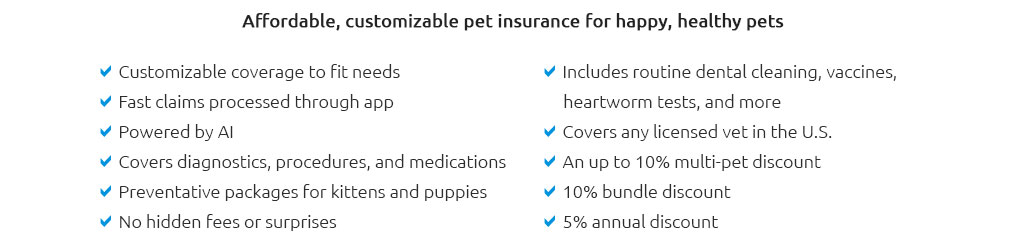

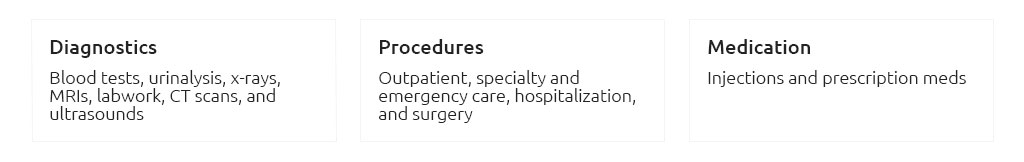

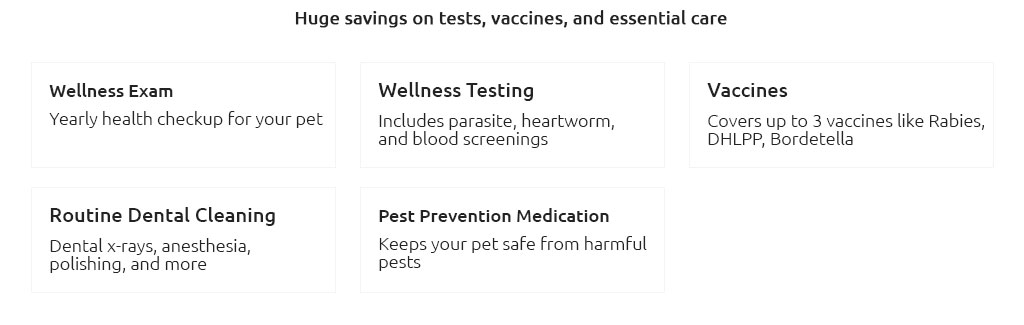

- What types of coverage are available? Coverage typically falls into three categories: accident-only, illness-only, and comprehensive plans. Accident-only policies cover unexpected injuries, while illness-only plans cover diseases. Comprehensive plans, often the most expensive, cover both accidents and illnesses, and sometimes preventive care.

- Are pre-existing conditions covered? Generally, pre-existing conditions are not covered by pet insurance policies. It's essential to enroll pets when they are young and healthy to avoid exclusions on future conditions. Some insurers might offer coverage after a certain period if the condition has been cured or is under control.

- How do I choose the right plan? Selecting a pet insurance plan in West Virginia involves comparing premiums, deductibles, reimbursement rates, and coverage limits. It’s crucial to assess the specific needs of your pet, including breed-related health issues, to determine the most suitable policy.

- What are the limitations of pet insurance? It’s important to be aware that pet insurance policies often come with limitations such as caps on payouts, waiting periods, and age restrictions. Additionally, routine check-ups and vaccinations might not be covered unless specified in the policy.

- Is it worth the cost? This depends on individual circumstances. While some may view pet insurance as an unnecessary expense, others see it as a critical investment in their pet’s health. The peace of mind that comes with knowing you can provide necessary care without financial strain often outweighs the cost for many pet owners.

In conclusion, pet insurance can be a valuable tool for pet owners in West Virginia, offering both financial protection and peace of mind. By understanding the different aspects of pet insurance, from coverage types to limitations, you can make an informed decision that best suits your pet’s needs and your budget.

|

|